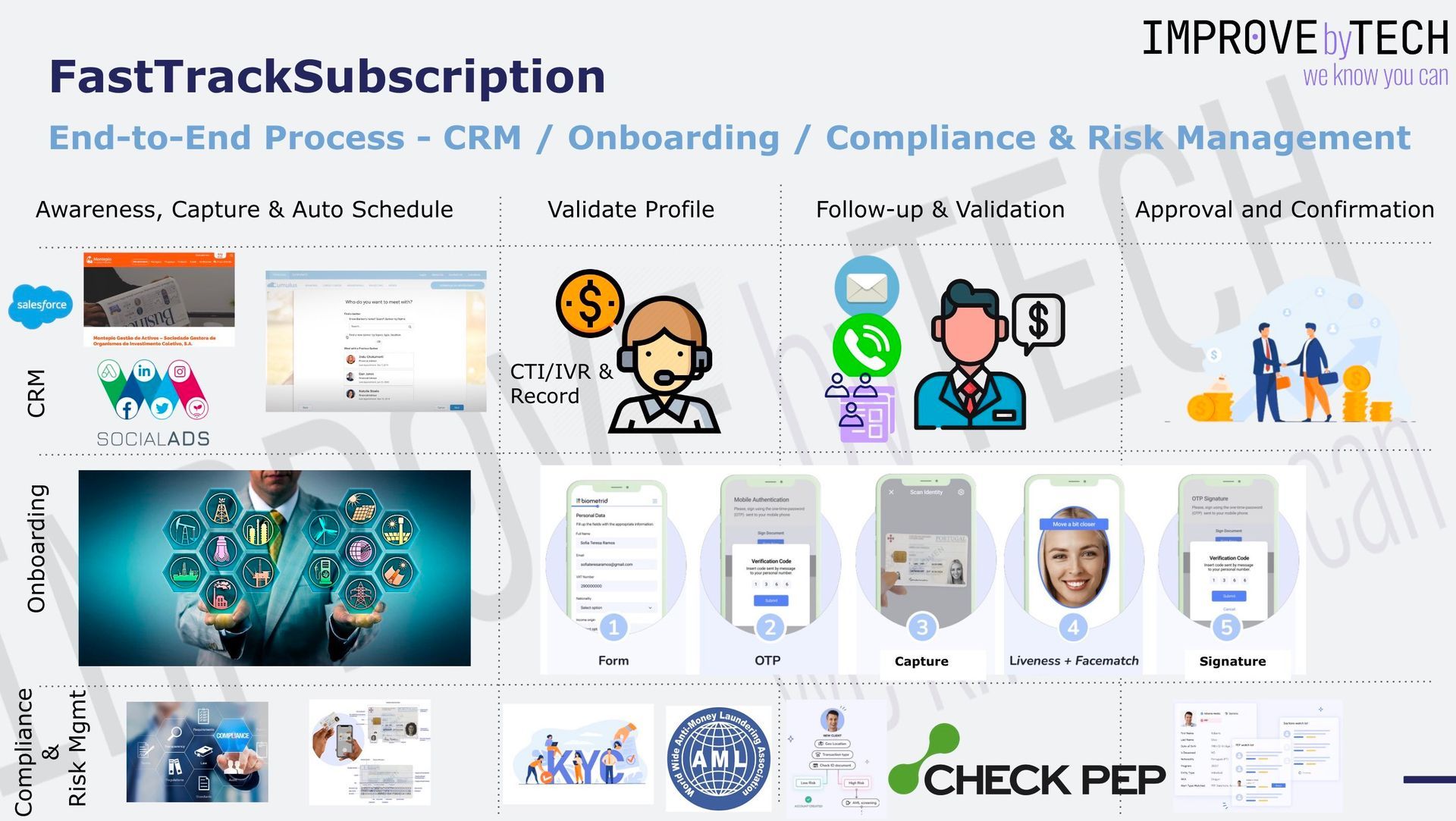

ImproveByTech - FastTrackSubscription

The fastest way to win digital customers

Financial Services and Insurance

Financial and insurance companies may have several reasons to adopt digital onboarding processes. Here are three main reasons:

- Efficiency: Digital onboarding can help financial and insurance companies streamline their operations and reduce the time and costs associated with manual processes. By automating the onboarding process, companies can eliminate paper-based forms and reduce the need for in-person meetings. This can help companies process applications faster, reduce errors, and improve customer satisfaction.

- Compliance: Digital onboarding can help companies comply with regulatory requirements. KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations require financial and insurance companies to verify the identity of their customers and monitor their transactions. Digital onboarding can help companies meet these requirements more efficiently by automating the verification process and conducting risk assessments.

- Customer experience: Digital onboarding can improve the overall customer experience by making it easier for customers to open accounts or purchase insurance products. Digital onboarding can allow customers to complete the onboarding process from anywhere at any time, using their mobile devices or computers. This can help companies attract and retain customers who value convenience and ease of use.